A year since his appointment as CEO of De Beers Group, Bruce Cleaver, who first joined De Beers in 2005, speaks to Belinda Morris about the industry today and the challenges ahead.

How will you promote and advertise diamonds after the industry has lost so much ground to other luxury products?

Our approach to marketing is twofold: via proprietary channels and partnership approaches. The former was developed around 10 years ago when we formed De Beers Diamond Jewellery (DBDJ), which has established a growing business in greater China and with Chinese clients worldwide, an established presence in London and Paris, and a new flagship location in New York City, and the Forevermark diamond brand (now in more than 2,000 retail doors globally).

This model was introduced as a result of De Beers’ changing business environment – we used to have a very high market share, so it made sense to invest in category-based marketing on behalf of the entire industry, even though we were the only ones really spending on generic diamond promotion. However, our market share reduced sharply in the early 2000s – it is now around 30-35% by value, much lower than before – so we needed to approach our role in global marketing in a different way. This is when DBDJ and Forevermark were born and we moved away from independently supporting the entire category’s marketing investment.

However, this changing dynamic led to something of a vacuum in generic diamond promotion, so it is really positive the various leading producers have recognised that category-based promotion is an area on which we can collaborate in a mutually beneficial way. It is right the various producers should share the financial cost of the Diamond Producers Association (DPA) and I am pleased to say that we have seen it deliver substantial benefits already.

Is the DPA’s ‘Real is Rare’ campaign proving successful?

‘Real is Rare’ has definitely been a vital step forward for the sector. The response from the trade has been very positive and it has connected consumers to the industry in a different way. But to appreciate the major benefits of the campaign, it is important to understand that there are two aspects to diamond marketing: short-term demand and long-term demand. Short-term demand is about driving people into retail outlets just before major selling occasions.

It is undoubtedly effective, but does not really impact long-term attitudes and behaviours. Long-term marketing is about shaping generational thoughts and feelings about a product and encouraging younger consumers to understand the symbolic power of diamonds that connect them to a very important and inherent human need. That connection needs to be reasserted in young consumers’ minds, as they have not had exposure to the same amount of promotional messages as previous generations.

What are your views on defending rough and polished prices and increasing margins throughout the pipeline?

It is important for businesses to focus on their key strengths, build strong customer relationships, stay financially robust, focus on accessing good information, inspire confidence in their supply chain partners and be operationally flexible. Doing these things and maintaining success builds a profitable organisation, regardless of the external environment and its challenges.

However, there is no doubt that it is a more competitive environment today, and the cost of rough diamonds can be expected to increase over time as mines get deeper and more remote, and thus the recovery process becomes costlier. So we all have to work hard to ensure we maintain relevance and do not just compete on price alone. If we seek to focus only on price and not on how we build value, then we do not have much of a future.

The use of technology will also continue to be a crucial factor in making businesses as efficient as they possibly can be.

Polishing a rough diamond.

Which markets are the key drivers in diamond prices and sales currently?

The US continues to drive global polished diamond demand. Meanwhile, we are also seeing some encouraging signs from India after a challenging period, as well as some more positive activity in the Far East after a slowdown in the rate of growth in China.

The US really is an amazing story of demand – despite being by far the largest and most mature market for diamond jewellery; it is still driving global growth. Longer term, we have real excitement that China and India will continue to fuel global growth in the same way as we are seeing the US do currently.

What are your views on defending diamonds against those selling them online as a cheap commodity?

Diamonds are, I believe, the ultimate luxury product – and should always be promoted as such. While some businesses may have a more short-term approach to selling their inventory, we believe that our long-term marketing activity will help reinforce the position of diamonds as ultimate luxury items and encourage retailing approaches to reflect this. We will also reinforce this message through the premium positioning of our Forevermark brand and our De Beers Diamond Jewellers retail outlets.

Our retail studies show that increasing numbers of consumers are asking retailers about branded diamond jewellery, so it is vital that we as an industry continue to provide compelling, differentiated and exciting branded offerings.

Clearly online is becoming a more important channel, both for research and sales, but we believe consumers will always be more enticed by the diamond dream if they can also see and touch the product, and if they can share in the story of their diamond. It is the job of all those involved in jewellery retail to remind consumers of the immense history of diamonds, their uniqueness and rarity.

Inspecting a diamond cut.

Are lab-grown diamonds a continuing trend? Are they a threat or simply a reality now?

If there is one thing we have learnt about diamond marketing over the years, it is that consumers desire what is real and rare – synthetics simply do not offer the emotional resonance that is central to the diamond purchasing decision.

Synthetics already occupy something of a place in the industry as diamond imitation products and I would expect that to continue, like with other synthetic gemstones. But they will rapidly see very considerable reductions in value – some categories have already plummeted to less than half of what they were worth two years ago – and they are likely to end up in the same kind of place as synthetic emeralds, rubies and sapphires which are now worth a fraction of the natural counterpart.

Synthetics do not have enduring value; they simply cannot fill the same symbolic space that has been the basis of the huge success of diamonds.

Where is the diamond industry now with regards to responsible business practices?

I believe the industry overall has made great strides in this area, led by De Beers, and has a very positive story to tell. It is perhaps one of the most heavily scrutinised and monitored industries and diamonds do a huge amount of good around the world. Around 10 million people are supported by the diamond industry globally and we have seen countries such as Botswana undergo huge economic development thanks to the wise management of their diamond resources that could, in many ways, offer a prototype for collaboration between the public and private sectors.

Sometimes the industry can be a little too modest – many of our Sight holders have amazing social programmes around their operations, but the stories of their initiatives have not been told. It is time we started shining more of a light on the light that diamonds bring to so many lives around the world.

Sorting rough diamonds.

How is your exploration going and are there any new projects coming on stream?

Exploration is always tough as so few mines are ever discovered — there has historically been a very low hit rate when it comes to diamondiferous kimberlite pipes, let alone those that are economically viable to mine. But De Beers was one of the few diamond companies to keep its exploration budget stable this year at c. US $30m-35m, and we continue to focus our activities on our prospective areas in Botswana, Canada and South Africa.

We are also soon to launch the world’s most sophisticated diamond sampling and exploration vessel, the mv SS Nujoma, off the Namibian Atlantic coast so the future is looking bright. ■

Interested in finding out more about gemmology? Sign-up to one of Gem-A’s courses or workshops.

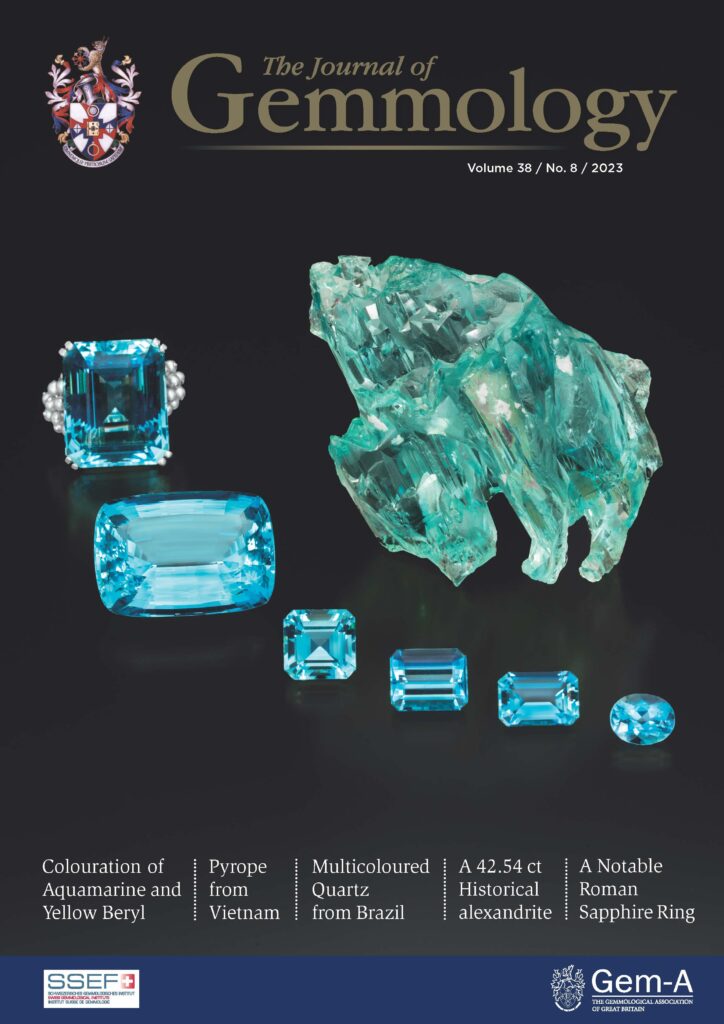

If you would like to subscribe to Gems&Jewellery and The Journal of Gemmology please visit Membership.

Cover image Namdeb Platform in Namibia. Images courtesy of De Beers Group.

{module Blog Articles Widget}